June 2021 Member Spotlight

Cindy Grove, Mountain View Bank of Commerce

Cindy Grove, Mountain View Bank of Commerce

Our very own Peter Melby will be presenting:

Boss or Babysitter?

Building a sustainable culture of success

Leaders shouldn’t have to babysit team members, but we all end up doing just that at some point. Teams encounter a conundrum: When we trust employees to act on their own, they often don’t do what we need them to do. When we micro-manage them, they don’t perform to their potential and everyone is miserable. We get burned either way. The ticket out of “The Babysitter’s Club” is surprisingly simple, yet nearly always overlooked. Peter Melby, CEO of Greystone Technology, shares stories and experiences outlining the journey to deeply successful culture in an IT company with over 100 team members. He’ll share a simple, proven methodology for organizations at any stage to communicate effectively with team members and avoid the people problems that all successful IT teams must overcome. Peter has shared these insights across the US, Europe, Australia, and Asia in an effort to redefine our global approach to company culture.

Bio

Peter Melby is the CEO of Denver-based IT service provider, Greystone Technology, a six-time Inc. 5000 honoree and a seven-time Top Workplace winner. Peter has been named one of Colorado’s Top 25 CEOs, 40 Under 40, Titan 100, and a ChannelPro 20/20 visionary. His leadership at Greystone has led to 17 consecutive years of growth and consistent recognition for market innovation. Peter speaks globally on topics related to scaling successful culture, disrupting traditional IT ineffectiveness, and common-sense cyber security.

Alex Dvorak, Transworld Business Advisors

Bryan Guice, Centennial Leasing & Sales

Ken Galecki, Exit360 Business Brokers

From Bob Dodge, Chair of our Member Engagement Committee:

Many of us enjoyed seeing one another in April and we look forward to seeing more DABBERs in person in May. As we learned, via the survey, we clearly value relationships with one another, and it is to that end that we will use the bulk of our time in May doing just that. We will sit at assigned tables with people who are not in our PAG, not on our committee and a mix of new and old members. Rather than focus on what we do, we’ll share who we are. Be thinking about this and come prepared to share who you are among your clients, peers, co-workers, and relatives. Also come prepared to learn things about DAB members that you don’t currently know.

For in-person attendance, RSVP here.

Yes, Zoomers will get the same opportunity via assigned breakout rooms as fellow in-person members/guests. If you plan to Zoom, please let Finola know. Thank you!

Mental health and resiliency have become more important since the start of the COVID pandemic. According to the Colorado School of Public health 23% of Coloradans met the criteria for major depressive disorder during the lockdown. Pre-pandemic about 7% did. While hope is on the horizon with the release of the vaccine it may be months before things feel more like normal. Learning to deal with stress, loneliness, isolation, and feeling down can help us at work and at home with loved ones.

Our April Speaker, Amy Morrison, will help us understand how we become stressed and depressed and how to deal with it in a constructive way. Amy Morrison is a Licensed Professional Counselor and Wellness Consultant who specializes in educating others about the nervous system. She is a co-founder of True Core Health and has worked with The Savory Institute, lululemon Athletica, Havenly, Cherry Creek Mortgage Company, and The Denver Design District.

If you need the Zoom details to join this meeting, please email finola.annibella@yahoo.com.

Suraya Yahaya, Khazana, Inc.

Member Engagement Meeting & Guests are Welcome to Join Us

Member Engagement Meeting & Guests are Welcome to Join Us

If you need the Zoom details to join this meeting, please email finola.annibella@yahoo.com.

Taxes – nobody likes paying them but we all have to deal with them. Whether you’re a business owner or employee, the rules keep changing and the DAB is here to help. Three of our very own members walked us through recent changes in the PPP guidance for businesses as well as some tax planning tips for business owners and individuals.

Our panelists included: Cindy Grove, Cindy Gomerdinger & Dan Giordano. Our moderator was Eric Walters.

Cindy Grove, Senior V.P. Relationship Manager

PPP ROUND 2 QUICK OVERVIEW

The first round of the SBA and PPP Loans was a source of much confusion but the second round has a lot more clarity. Those who missed getting $$ in Round One they are likely to get loans in round Two.

The $284 Billion funding of Round 2 PPP has the following requirements:

How round 2 is calculated, you can just re-apply for Round 1 calculations or re-calculate the 2.5x average monthly payroll costs. Businesses with a NAICS code (north American industry classification system you can find on your tax return) Starting with 7’s includes arts, entertainment recreation accommodations and food services may use 3.5x. There is a 5 year repay @1% rate.

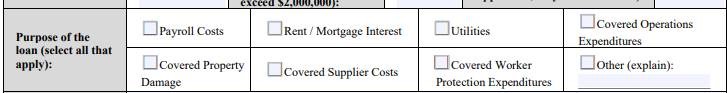

The EIDL Grant funds are now “not excluded” from forgiveness and reconciliations / refunds being processed. Round 2 has expanded categories the funds can be used for the following:

Cindy Gomerdinger, Owner

Is the PPP forgiveness taxable? No, from the beginning the intention was that the forgiveness of debt from the PPP would not be taxable. However, the IRS later pointed out that expenses associated with tax exempt income are not deductible. Therefore, the impact on the taxable income would have been the same as if the debt forgiveness was taxable. On 12/27 they fixed this in the 2nd stimulus package and now the original PPP loans and the 2nd Draw PPP loans will not be considered income AND the expenses associated with the forgiveness are deductible.

Is the EIDL Advance taxable? No, it is not taxable and it will be fully forgiven. They fixed this in the 2nd stimulus package as well. For those that applied for forgiveness last year, the $10K advance was excluded from the forgiveness and you either continued to owe it back through a loan or you repaid it. Due to the 2nd stimulus package fixing this error, any amounts repaid on the advance will be paid by the SBA to the bank and the bank will send you a reimbursement.

What happens if you received a stimulus payment (individually), but your 2020 income is too high to qualify for it? You will not have to return the excess stimulus via the filing of your 2020 return. It is “yours” even if your income was too high in 2020. If you did NOT get a stimulus payment and your 2020 tax return reflects income lower than the thresholds of $150K for joint filers and $75K for single, you will be able to get the stimulus through a “credit” on your 2020 tax return.

Are W2 wages taxable if paid for through the PPP funds? Yes, they are taxable to the employee regardless as to whether the payroll was funded with PPP $’s.

Dan Giordano, Founding Partner and Principal

Some employers might qualify for Employee Retention Credits (ERC). The opportunity to qualify for these credits is simplified now when compared to when they were first legislated in March of 2020. Previously, employers who selected Paycheck Protection Program (PPP) loans weren’t eligible for ERCs, but now, the same employer might qualify for both. One important consideration is wages used for PPP forgiveness cannot be considered and part of calculations for ERCs. Said different, wages cannot be duplicated for these purposes. Therefore careful consideration should be given to wages utilized in PPP loan forgiveness applications and wages utilized for ERC calculations. Consultation with a businesses’ payroll service provider is relevant because ERCs affect current payroll tax filing forms and there is potentially an opportunity to go back to 2020 to recognize ERCs which might be refundable to the business. IRS guidance continues to be issued with respect to these benefits.

Aside from PPP loans and ERC’s, opportunity may exist for certain employers and self-employed individuals to gain benefit from Paid Sick Leave and Family Leave credits. Again, consulting with your team of professionals to optimize your opportunities is prudent. As it concerns the question about breakeven for employer tax credits for these benefits, in GENERAL terms (specifics must be analyzed on a case by case basis), benefits might be assessed in the following order or priority, versus a breakeven analysis:

Items 2 and 3 above depend on employer size (number of employees) and payroll service provider’s ability to get everything computed. IRS forms and instructions are just emerging (leave credits form and instructions were just issued 01.28.21).

A big thank you to Cynthia Wellbrock who is the author of this article.